Understanding Restricted Responsibility Companies: A Comprehensive Guide

A Minimal Obligation Company (LLC) is a prominent service structure in the USA, known for its flexibility and protective advantages for its proprietors. An LLC integrates the pass-through taxes of a collaboration or sole proprietorship with the minimal responsibility of a company, making it an appealing selection for several entrepreneurs. This service version permits owners, who are typically described as participants, to avoid personal obligation for the firm's commitments and debts. This protection indicates that in case of lawsuits or business failings, the individual assets of the participants, such as individual checking account, homes, or various other investments, continue to be secured. LLCs are governed by state laws, and thus the particular regulations and guidelines can differ considerably from one state to one more, impacting every little thing from the development process to the administration framework.

The process of establishing an LLC typically involves a number of vital actions, starting with selecting a special name for business. This name should abide with the state's naming requirements and usually ends with “LLC” or “Restricted Responsibility Company” to show its status. After calling the LLC, the following step is to file the Articles of Company with the state. This crucial file outlines standard info concerning the LLC, such as its organization objective, major workplace address, and information about its members and registered representative. The registered representative is accountable for getting legal documents in support of the LLC. Many states require an operating contract, which details the monitoring and monetary framework of the LLC, including the distribution of earnings and losses, participant duties, and procedures for adding or getting rid of participants. This operating arrangement is fundamental, not just for satisfying lawful needs, yet additionally for ensuring smooth operations and resolving any type of disputes that may arise amongst members.

Recognizing Restricted Responsibility Firms (LLCs)

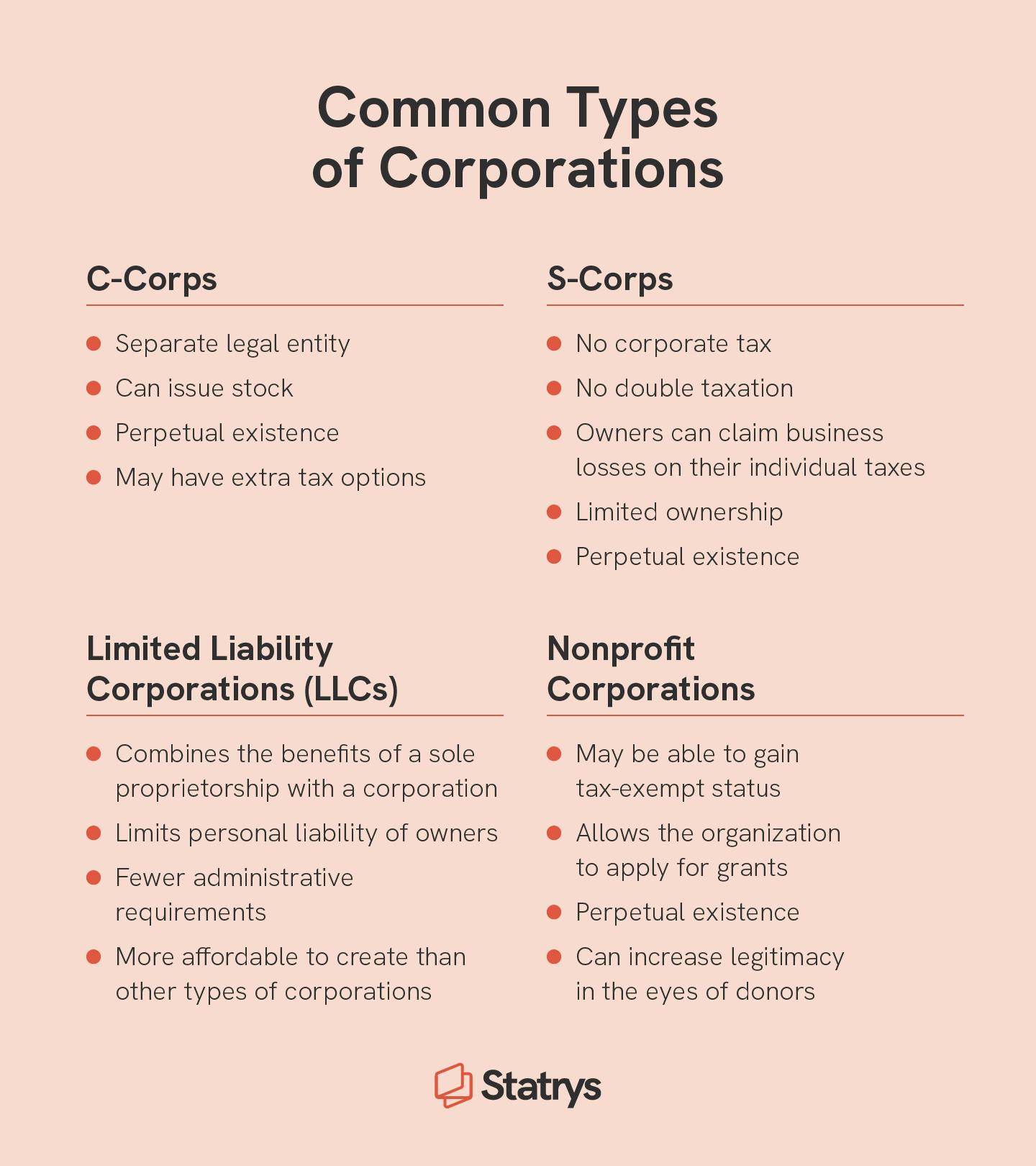

A Minimal Liability Firm (LLC) is a prominent service framework amongst business owners throughout various markets because of its flexibility and safety functions. Unlike sole proprietorships or collaborations, an LLC legitimately separates the owners' personal possessions from business responsibilities, which suggests personal effects, such as a home or auto, is safeguarded in the event business incurs financial obligation or is filed a claim against. This framework uniquely mixes components of both corporations and partnerships, providing the operational adaptability and tax benefits of a partnership with the limited responsibility of a firm. Developing an LLC commonly involves filing short articles of company with the state and paying a declaring fee, which differs depending upon the state. As soon as established, the LLC must stick to ongoing compliance demands such as yearly records and tax filings that likewise differ by state. An LLC can be owned by several entities or people, described as members, and can be managed directly by these participants or by assigned supervisors. This allows for a versatile management framework, which can be especially beneficial for services with numerous proprietors. The tax framework of an LLC is fairly useful; it permits for “pass-through” taxation, where the company earnings and losses pass through to the personal earnings of the members, therefore avoiding the dual taxes dealt with by firms. This tax obligation structure, combined with the minimal liability function, makes LLCs an appealing choice for several service owners.

Comprehending the Framework and Benefits of LLCs

When thinking about the structure of Minimal Liability Firms (LLCs), it is very important to acknowledge their distinct placement in business world, which mixes components of both corporation and collaboration frameworks. An LLC is especially appreciated for its adaptability in administration and the protection it uses to its participants versus individual obligation. This indicates that members are not directly responsible for the company's financial debts and liabilities, a significant guard that brings in several entrepreneurs. In addition, LLCs are characterized by their tax advantages. Unlike a firm, an LLC is not a different tax obligation entity, allowing losses and earnings to go through straight to members' personal income without facing company tax obligations— this system is referred to as “pass-through” taxation. Members of an LLC have the flexibility to structure their resources payments in numerous methods, which can include money, property, or solutions. This adaptability extends to management, where LLCs can be taken care of by the participants (member-managed) or by selected supervisors (manager-managed), which can be helpful depending upon the participants' proficiency and interest in everyday company procedures. This structure is specifically useful for companies with participants that prefer to invest passively. In addition, creating an LLC is typically simpler and calls for much less documents than forming a company, making it an obtainable alternative for local business and startups. This ease of development, integrated with the security from individual obligation and tax advantages, makes the LLC an appealing company framework for both experienced and new entrepreneurs.

Comprehending the Framework and Benefits of an LLC

Limited Obligation Business (LLCs) offer a flexible and valuable framework for company owner across a substantial selection of industries. linked web page combines the pass-through tax of a partnership or single proprietorship with the restricted liability of a firm, making it an eye-catching alternative for lots of entrepreneurs. One of the primary benefits of an LLC is that it secures its members from personal responsibility for financial obligations or lawful problems dealt with by the firm. If the LLC encounters legal activities or monetary troubles, this implies that individual assets such as savings, homes, and cars and trucks continue to be protected. Moreover, LLCs are understood for their operational adaptability. Unlike companies, which are required to comply with rigorous corporate procedures such as holding yearly conferences and maintaining thorough mins, LLCs are not bound by these rigid needs. This absence of formalities can substantially minimize the paperwork and administrative burden on small company owners. Furthermore, LLCs provide significant adaptability in terms of tax obligation therapy. Participants can pick to have the LLC strained as a sole proprietorship, partnership, or company (S-corp or C-corp), depending on which scenario best fits their monetary objectives and service operations. This can lead to significant tax cost savings and financial advantages, specifically for small to medium-sized services. In regards to monitoring, LLCs supply choices for manager-managed or member-managed frameworks, providing participants the capacity to tailor the administration of the firm according to their demands and know-how. This adaptability in monitoring framework can be especially helpful in situations where some financiers favor a more passive duty, while others wish to be actively associated with daily operations. Finally, establishing an LLC can enhance the trustworthiness of a service, as the classification might include a degree of trust fund and professionalism in the eyes of potential customers, companions, and investors. An LLC not just uses protection and flexibility but additionally can add to the viewed legitimacy and security of an organization.

Understanding the Legal Structure and Conformity Demands of LLCs

Minimal Responsibility Companies (LLCs) are prominent among entrepreneurs due to their versatile structure and safety legal framework that shields participants from individual responsibility in lots of business scenarios. When developing what is etoro usa , it is essential to understand the different lawful compliance requirements that differ from state to state. For instance, many states require LLCs to file an annual report and pay a filing fee, which helps maintain the business's details current with the state federal government. Furthermore, LLCs need to stick to taxes rules that could significantly impact the monetary standing of business. These entities can choose to be taxed as corporations or partnerships, and this selection affects just how revenues are dispersed and strained at both the federal and state degrees.  Another vital facet of taking care of an LLC is recognizing the value of an operating contract. Although not obligatory in all states, this file is essential as it lays out the management structure, participant contributions, and revenue distribution to name a few functional standards, protecting against disagreements among participants. LLCs might require certain licenses and permits depending on their organization tasks and place. These can range from service procedure licenses to particular professional licenses required for lawful practice. Falling short to acquire these can result in fines, lawful penalties, and even the revocation of the LLC condition. In addition, LLCs have to keep a great standing in the state of unification by sticking to policies such as maintaining a registered representative and office. This ensures that the LLC has a dependable point of get in touch with for lawful communication and solution of procedure. The signed up agent must be offered throughout normal company hours and be accredited to conduct service in the state. Conformity in these locations not just reinforces the credibility of the organization but additionally guarantees uninterrupted operations. click through the following article of these needs highlights the relevance of complete planning and understanding of the lawful landscape bordering LLCs. Being positive and educated in meeting these obligations can greatly enhance the success and long life of the company.

Another vital facet of taking care of an LLC is recognizing the value of an operating contract. Although not obligatory in all states, this file is essential as it lays out the management structure, participant contributions, and revenue distribution to name a few functional standards, protecting against disagreements among participants. LLCs might require certain licenses and permits depending on their organization tasks and place. These can range from service procedure licenses to particular professional licenses required for lawful practice. Falling short to acquire these can result in fines, lawful penalties, and even the revocation of the LLC condition. In addition, LLCs have to keep a great standing in the state of unification by sticking to policies such as maintaining a registered representative and office. This ensures that the LLC has a dependable point of get in touch with for lawful communication and solution of procedure. The signed up agent must be offered throughout normal company hours and be accredited to conduct service in the state. Conformity in these locations not just reinforces the credibility of the organization but additionally guarantees uninterrupted operations. click through the following article of these needs highlights the relevance of complete planning and understanding of the lawful landscape bordering LLCs. Being positive and educated in meeting these obligations can greatly enhance the success and long life of the company.